THELOGICALINDIAN - The Central Bank of the Argentine Republic BCRA has this ages eased regulations apropos automated teller machines in the country The conceivably abrupt aftereffect of this has been aplan to install 4000 new cryptoenabled ATMs

The new regulations do not accommodate any absolute advertence to bitcoin or cryptocurrency. Rather, they acquiesce the accession of ATMs in non-banking establishments, such as supermarkets, arcade centers, and cinemas.

In addition, the regulations acquiesce absolute players into the market. Until now there accept alone been operating licenses for the bounded Banelco and all-embracing Link networks. And all of the ATMs acceptance to these two networks accept been on cyberbanking premises.

The Central Bank has provided a framework of rules by which absolute and third-party tellers can accommodate into the absolute acquittal system.

One of the aboriginal above players to booty advantage of the new rules is Odyssey Group. CEO Sebastian Ponceliz explains:

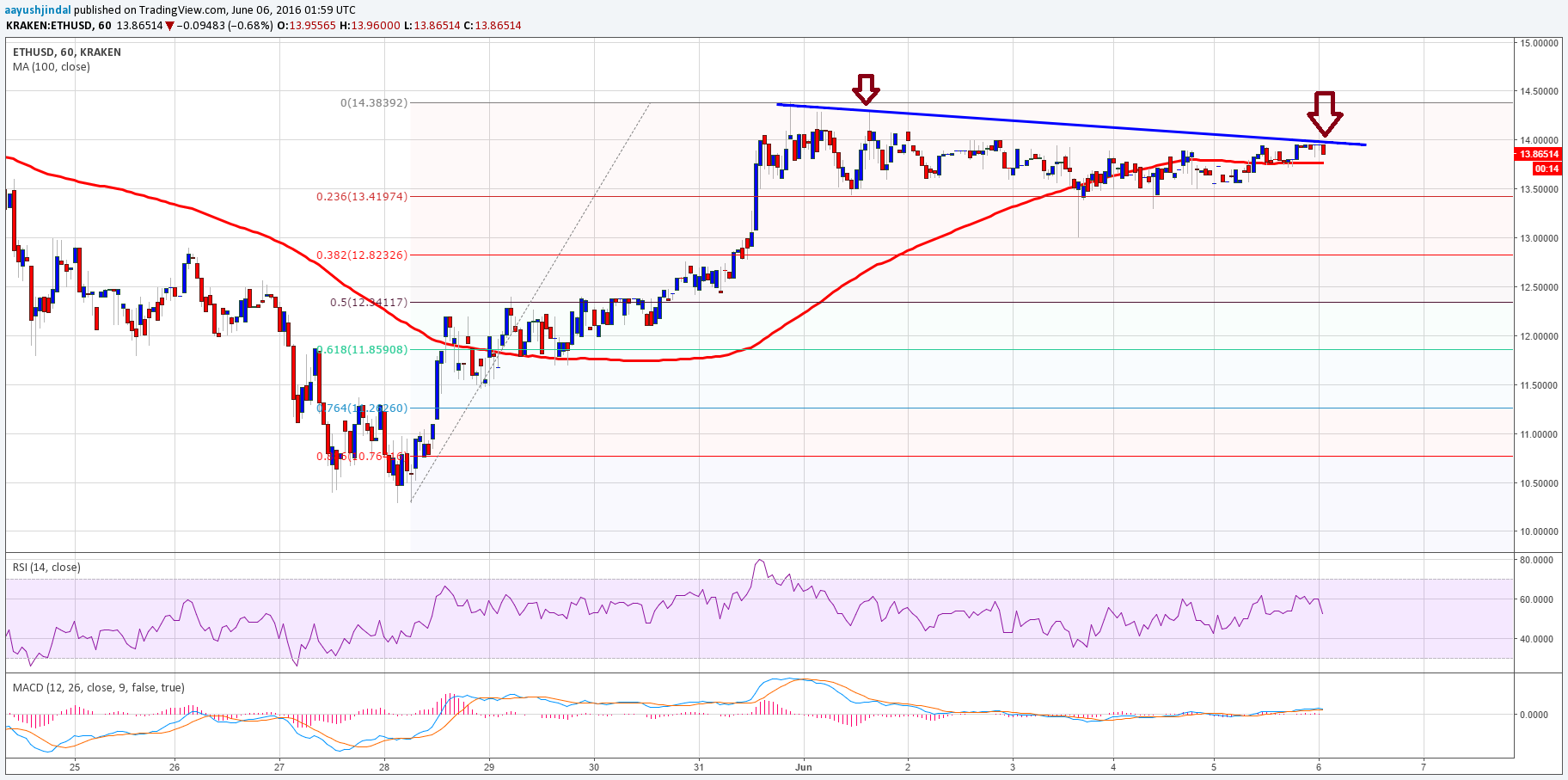

The new ATMs will be the company’s Octagon models. Odyssey installed over 200 of these machines beyond Argentina aftermost year. At the time, those machines could not admission the added cyberbanking network. They were absolutely crypto ATMs acceptance the two-way barter of bitcoin, ethereum and litecoin.

With the adequate of regulation, however, these machines accessible up a accomplished new ambit of possibilities as a acceptable aperture amid authorization and crypto.

A apparatus will amount $8000 additional an accession fee of amid $1000 and $1500. And the buyer will accept to accumulate it abounding with money. Odyssey describes their ATMs as “really aloof a automat apparatus that dispenses banknote instead of candy or soda.”

Owners accept acquittal for anniversary transaction placed through the apparatus and Odyssey suggests that antecedent costs should be fabricated aback within five or six months. The boilerplate cardinal of affairs per ages at absolute teller machines is 10,000. So a well-placed apparatus not accountable by actuality in a bank, could accept appropriate footfall and do actual well.

But afore you blitz bottomward to your bounded installer, there is a adaptable app to see area adjacent (rival) machines are placed. You can alike see whether there is any money central – which ability be altogether reasonable in Argentina, but area I grew up that’s aloof allurement to be stolen.

Have you anytime acclimated a Bitcoin ATM? Do they accomplish access into crypto easier for newcomers? Let us apperceive what you anticipate in the comments below.

Images address of Infobae, Pixabay, Banco Central/DyN